Daryl M. Adams

President and Chief Executive Officer

The Shyft Group

Fellow Shareholders

This past year was another challenging year for our team at The Shyft Group. Resiliency became the true test for winning in this environment, contributing to a remarkable year for the Shyft Group.

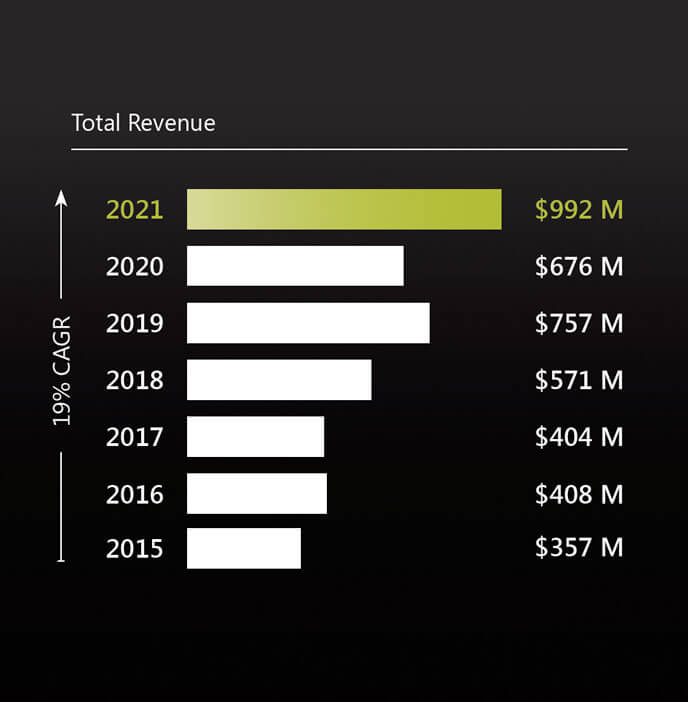

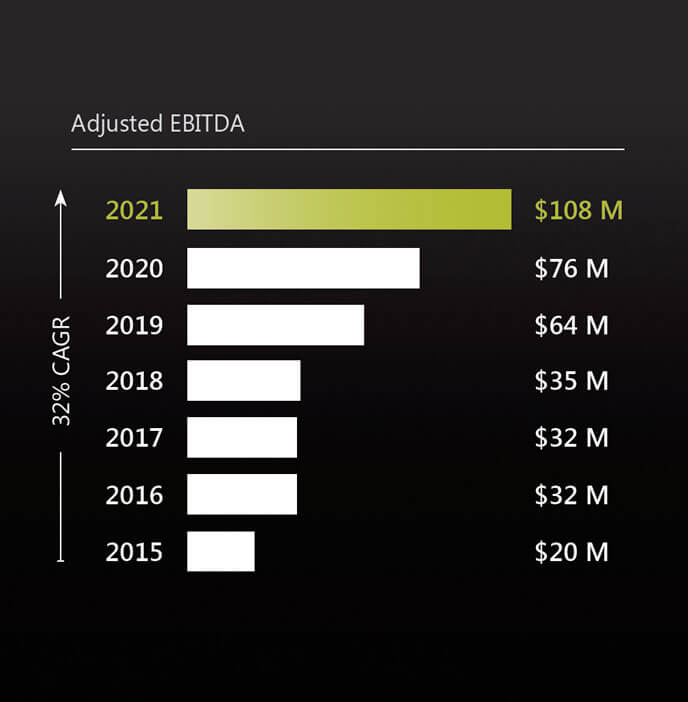

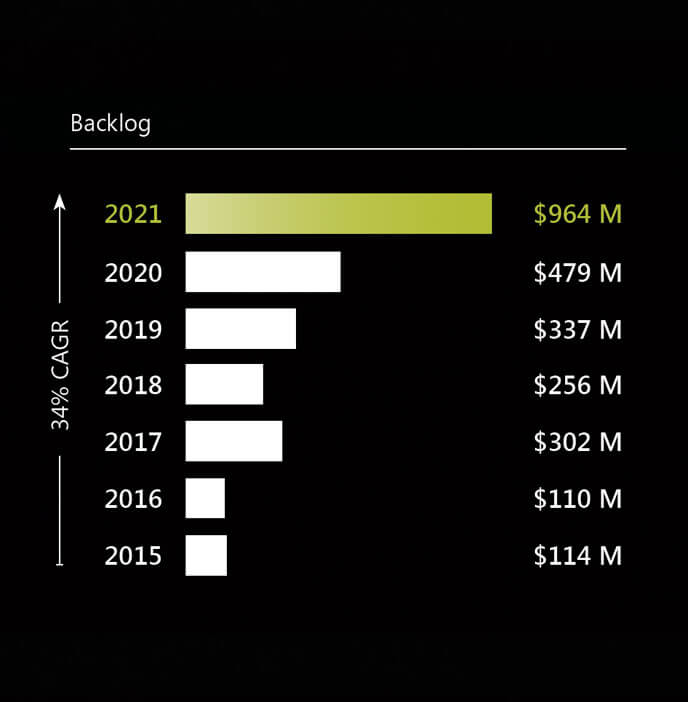

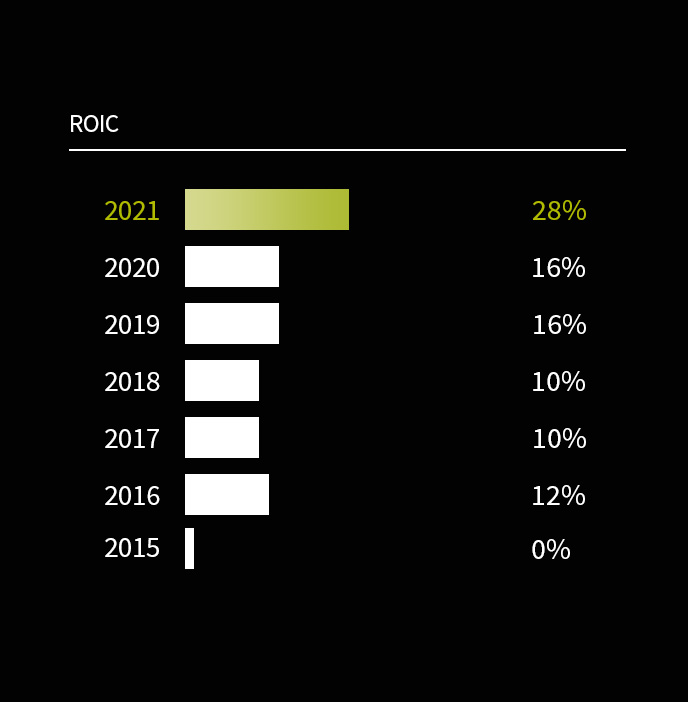

The impact of COVID-19 continued to challenge our resources and supply chain while simultaneously driving immense demand for our products in last-mile delivery and infrastructure. Our team proactively managed through it all with resourcefulness and relentless focus on execution for our customers to deliver consistent, industry-leading results quarter after quarter. In fact, it was a year of records for us – delivering $108M of adjusted EBITDA on 47% revenue growth. We generated significant cash and took our debt down to zero while nearly doubling our investment in R&D to position us for our next stage of growth.

Capping off a record year, the Shyft Group was honored as one of Fortune’s 100 Fastest-Growing Companies. We were excited to be recognized in this way as we continue executing our strategy and focusing on high-value, high-growth markets – a journey that began in 2015.

Our leadership emphasizes we must be agile, nimble, flexible, proactive, and solution-based in everything we do. Last year was both humbling and rewarding, seeing that approach in action – and a great reminder of what is truly possible with the right strategy and the right team.

A primary example is our Velocity® F2 walk-in van, which made its debut delivering packages around the country in 2021. The team listened to our customers’ need for a new product that would help meet their rapidly growing e-commerce and delivery demand and answered by creating an entirely new category of purpose-built Class 2 walk-in delivery vehicles. This customer-driven, solution-focused innovation exemplifies the Shyft Group DNA and is key to our ongoing success.

We continued to invest and strengthen our core to meet evolving trends, such as electrification. We announced a plan to build our own EV chassis and last-mile electric delivery vehicle last June in support of a more environmentally sustainable future for all. By leveraging our 50-year heritage in chassis manufacturing for specialty vehicles and body building for last-mile delivery with exceptional engineering talent, we unveiled a prototype at NTEA Work Truck Week in March of 2022, receiving an extremely positive response from our customers. I’m proud to say we are undoubtedly wellpositioned in the EV space.

The Shyft Group is energized for the future – not only for the business opportunities that lie ahead with new customers, acquisitions, and innovations, but to continue focusing on our people. Ultimately, having an inclusive, diverse culture that harnesses employees’ individual and unique talents, experience, spirit, and passion is what allows the Shyft team to continually outperform the market and drive our strategy forward.

We are very focused on our future and look forward to continued success and driving shareholder value.